Average Homeowners Insurance Rates in the United States

If you haven't been watching, homeowners insurance rates have been on the increase. Over the past 5 years alone, average home insurance rates have increased over 24.57%. If you are purchasing a new home or curious about more affordable home insurance rates then it's a great idea to review and compare rates in your area.

Just like you, many are asking: "What's the average cost of homeowners insurance?". For a quick reference, the average home insurance rate for an annual premium based on an HO-3 standard homeowners insurance packaged policy in the United States is $1,311 a year or $109 a month. Our average home insurance data table below explains the average premium increases year over year.

Average Home Insurance Rates Per Year

| Year | Homeowners Premium | Percent Change |

|---|---|---|

| 2020 | $1,311 / yr. | 3.6% |

| 2019 | $1,272 | 1.8% |

| 2018 | $1,249 | 3.1% |

| 2017 | $1,211 | 1.6% |

| 2016 | $1,192 | 1.6% |

| 2015 | $1,173 | 3.6% |

| 2014 | $1,132 | 3.3% |

| 2013 | $1,096 | 5.9% |

| 2012 | $1,034 | 5.6% |

| 2011 | $979 | 7.7% |

| 2010 | $909 | 3.3% |

| 2009 | $880 | 6.0% |

| 2008 | $830 | 1.0% |

| 2007 | $822 | 2.2% |

| 2006 | $804 | 5.2% |

| 2005 | $764 | 4.8% |

| 2004 | $729 | 9.1% |

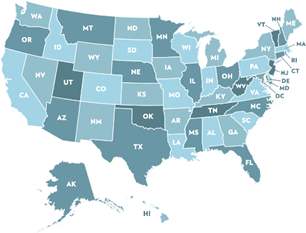

Average Home Insurance Rates By State

For average premiums for homeowners insurance by state, please review the table below. Below you will find that you can review average premiums paid annually or monthly for each state. Also available is the state rank in terms of where your state may rank on average compare to the rest of the country. The average annual premium for the United States is $1,034. The percent change column shows you the rate increases or decrease based on the percentage value shown for each state. If it rate has decreased you will see a negative value. For example, Misssissippi and Nevada are the only two states recently that have experienced rate decreases over the past year.

| State | Avg. Annual Premium | Avg. Monthly Premium | State Rank (Overall) | Change (%) |

|---|---|---|---|---|

| Alabama | $1501 | $ 125 | 11 | 2.6 |

| Alaska | $989 | $ 82 | 38 | 2.8 |

| Arizona | $866 | $ 72 | 46 | 1.9 |

| Arkansas | $1498 | $ 125 | 12 | 2.9 |

| California | $1241 | $ 103 | 24 | 5.4 |

| Colorado | $1667 | $ 139 | 7 | 3 |

| Connecticut | $1582 | $ 132 | 10 | 3.3 |

| Delaware | $907 | $ 76 | 44 | -0.1 |

| District of Columbia | $1229 | $ 102 | 26 | -3.6 |

| Florida | $2165 | $ 180 | 1 | 8.9 |

| Georgia | $1403 | $ 117 | 15 | 3 |

| Hawaii | $1245 | $ 104 | 23 | 5.3 |

| Idaho | $810 | $ 68 | 48 | 1.4 |

| Illinois | $1144 | $ 95 | 31 | 8.5 |

| Indiana | $1021 | $ 85 | 35 | 3.9 |

| Iowa | $998 | $ 83 | 37 | 9.3 |

| Kansas | $1478 | $ 123 | 14 | -2.7 |

| Kentucky | $1174 | $ 98 | 28 | 0.2 |

| Louisiana | $2038 | $ 170 | 3 | 0 |

| Maine | $956 | $ 80 | 42 | 2.1 |

| Maryland | $1169 | $ 97 | 29 | 3.9 |

| Massachusetts | $1667 | $ 139 | 8 | 3.1 |

| Michigan | $1002 | $ 84 | 36 | 0.3 |

| Minnesota | $1481 | $ 123 | 13 | 3.3 |

| Mississippi | $1674 | $ 140 | 6 | 3.2 |

| Missouri | $1301 | $ 108 | 20 | 0.2 |

| Montana | $1347 | $ 112 | 17 | 4.7 |

| Nebraska | $1586 | $ 132 | 9 | 1.4 |

| Nevada | $824 | $ 69 | 47 | 4.2 |

| New Hampshire | $1048 | $ 87 | 34 | 2.6 |

| New Jersey | $1277 | $ 106 | 22 | 3.2 |

| New Mexico | $1151 | $ 96 | 30 | 2.2 |

| New York | $1356 | $ 113 | 16 | -0.1 |

| North Carolina | $1119 | $ 93 | 32 | -6.2 |

| North Dakota | $1230 | $ 103 | 25 | -0.5 |

| Ohio | $871 | $ 73 | 45 | 2.1 |

| Oklahoma | $2040 | $ 170 | 2 | 2 |

| Oregon | $735 | $ 61 | 51 | 1.1 |

| Pennsylvania | $967 | $ 81 | 41 | 1.3 |

| Rhode Island | $1788 | $ 149 | 5 | 3.3 |

| South Carolina | $1327 | $ 111 | 18 | 1.8 |

| South Dakota | $1222 | $ 102 | 27 | 0.3 |

| Tennessee | $1296 | $ 108 | 21 | 2.9 |

| Texas | $2000 | $ 167 | 4 | 0.9 |

| Utah | $764 | $ 64 | 49 | 2.8 |

| Vermont | $984 | $ 82 | 39 | 3.9 |

| Virginia | $1107 | $ 92 | 33 | 2.5 |

| Washington | $937 | $ 78 | 43 | 3.2 |

| West Virginia | $974 | $ 81 | 40 | 0.6 |

| Wisconsin | $762 | $ 64 | 50 | 1.6 |

| Wyoming | $1308 | $ 109 | 19 | 5.1 |

| Total | $1,311 | $109.25 |

Top 5 Most Expensive States For Home Insurance Rates

| State | Avg. Annual Premium | Avg. Monthly Premium | State Rank (Overall) |

|---|---|---|---|

| Florida | $2165 | $ 180 | 1 |

| Oklahoma | $2040 | $ 170 | 2 |

| Louisiana | $2038 | $ 170 | 3 |

| Texas | $2000 | $ 167 | 4 |

| Rhode Island | $1788 | $ 149 | 5 |

Top 5 Most Affordable States For Home Insurance Rates

| State | Avg. Annual Premium | Avg. Monthly Premium | State Rank (Overall) |

|---|---|---|---|

| Oregon | $735 | $ 61 | 51 |

| Wisconsin | $762 | $ 64 | 50 |

| Utah | $764 | $ 64 | 49 |

| Idaho | $810 | $ 68 | 48 |

| Nevada | $824 | $ 69 | 47 |