How can the SC Safe Home Program Help Lower Insurance Prices?

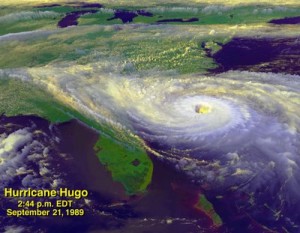

Shows the path of Hurricane Hugo on September 21, 1989 approaching the coast of South Carolina.

The South Carolina Safe Home Program under the aegis of the South Carolina Department of Insurance provides funds to individual homeowners to help them undertake retrofitting measures that will reinforce their homes against the ravaging effects of hurricanes and tropical storms. Homeowners whose properties have insured values of less than $300,000 are eligible for these grants while preference is shown to low- and medium-level income households. According to studies, homeowners report up to 25 percent savings on their home insurance premium values after undertaking mitigation improvements with the Safe Home Program grants. And how?

The Insurance Woes of South Carolina Homeowners

South Carolina homeowners, especially those who live in counties like Beaufort, Berkeley, Charleston, Dorchester, Georgetown, Jasper, and Williamsburg that are vulnerable to hurricanes and tropical storms, have to shell out much more by way of their home insurance premiums than residents elsewhere. After all, insurance companies too have to make profits and there have been countless instances in the recent past where they have had to incur heavy losses because homeowners had not sufficiently bolstered the defenses of their properties against hurricanes and storms. Apart from hiking insurance prices, insurance companies in South Carolina are also known to refuse coverage to homeowners who have not adequately fortified their houses.

How Does the South Carolina Safe Home Program Mitigate Homeowners’ Woes?

By granting funds to undertake structural repair and/or upgradation jobs on their homes, the South Carolina Safe Home Program lets homeowners make themselves eligible to receive insurance coverage and/or have hundreds of dollars slashed from their premium amounts.

In this context, it is worth noting that these grants are provided only for mitigation improvements (as opposed to home remodeling tasks) like fortifying roof deck attachments, creating additional water barriers, enhancing the stability of roof coverings, and bracing the gable-ends in roof framings. Homeowners can also use these funds to reinforce roof-to-wall connections, upgrade doors and windows installed on the exterior walls, and strengthen and/or replace anchors, piers, and tie-down straps in manufactured houses.

A Sense of Urgency

As reported in The Charlotte Observer, there will be above-average hurricane activity in the Atlantic and Caribbean coasts this year. This prediction has been made by a team of meteorologists at the Colorado State University and they have also forecasted more-than-usual incidences of landfall in the Carolinas regions. With the official six-month hurricane season in the Atlantic coast already underway—it extends from the 1st of June to the 30th of November—it is only natural that homeowners in South Carolina would be worried about the integrity of their properties. So the above-mentioned details about the SC Safe Home Program couldn’t have come at a better time, especially for those homeowners who can ill-afford retrofitting measures or spend large sums of money on an expensive home insurance policy.

THIS is the right time to consider applying for a SC Safe Home Program grant and the sense of urgency is palpable. After all, mitigation improvements can not only safeguard houses but also bring on oodles of savings for South Carolina homeowners.

For more information about insurance in South Carolina you can visit the South Carolina Department of Insurance website.