North Carolina Joint Underwriters and Wind Pool Map Explained

Ocracoke Island of North Carolina’s Outer Banks

North Carolina is a lovely state to call home. Our state is packed with beautiful cities, museums, restaurants and of course, some of the loveliest beaches in the country.

Unfortunately, if you live in one of our amazing coastal southern cities such as Ocean Isle Beach, Sunset Beach, Oak Island Beach, Calabash, Bald Head Island, Kure Beach, Wrightsville Beach, Morehead City, Emerald Isle or a city in the Outer Banks like Ocracoke, Nags Head, Manteo or Corolla, insuring your home against wind and hail damage (that often comes with hurricanes) can be difficult and expensive.

If your home is located in one of these high-risk cities or other coastal areas your standard homeowners insurance may not cover wind or hail damage and protecting your home against those two perils may be difficult and pricey.

Here is a quick look at what you need to know about wind and hail insurance in North Carolina.

High Risk Areas In North Carolina

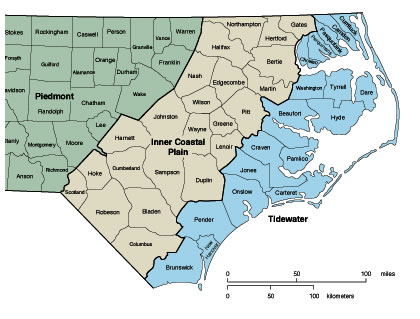

North Carolina Coastal Counties, Including Inner Coastal bordering east of I-95, and the tidewater counties bordering the Atlantic Ocean.

In North Carolina, all coastal counties, the 41 counties that are east of I-95, fall into what is called the Catastrophic Insurance Market. This simply means that properties that fall into this are prone to hurricanes, especially the 19 coastal counties that bump up to the Atlantic Ocean.

As an example of the severe weather coastal North Carolina faces, Hurricane Sandy resulted in $57 million in insurance claims in North Carolina alone. Five of the top 10 costliest hurricanes that hit the coast of the United States have done some type of damage in North Carolina.

In all of these hurricane prone counties it is very difficult to get homeowners insurance coverage in the private market as many insurers have pulled out and no longer write policies in this specific area and if they do, wind and hail damage is usually excluded from coverage.

In most of the coastal counties of North Carolina, homeowners will need an additional policy to be protected against wind and hail damage. Check your current insurance policy or check with your insurance agent to make sure your current policy fully protects you against wind and hail damage.

If it turns out you are not covered, you may need to find a policy with the FAIR Plan or the Coastal Property Insurance Pool, which was formerly known as the Beach Plan. This is the state run insurer of last resort for coastal communities.

For Coastal Homeowners, We Have Great News: We provide a value service to any homeowner living on the coast of NC, we can shop the best coastal NC insurance rates and help provide the best coverage for your home with the proper hurricane protection you need, also known as Wind and Hail Insurance.

Call Today! 1-866-918-3404 For Free Wind and Hail Insurance Quotes!

What does a Wind and Hail Policy Cover?

Windstorm insurance is designed to fill the gap that is left by homeowners policies that don’t offer coverage for wind and hail damage but this coverage only kicks in when certain criteria are met.

In most cases it will cover damage that is caused by high winds or hail associated with hurricanes, tornadoes or other high wind weather events. While requirements can vary, in most cases the wind must be gusting at least 35 miles per hour for coverage to kick in.

These policies will protect both your home and your personal belongings that are damaged by wind or hail. These policies will also cover outbuildings and other detached structures on your property. This includes garages, swimming pools, sheds and other outbuildings.

While these policies cover wind and hail damage, damage that is caused by flooding or storm surge is never covered. You would need a separate flood insurance policy for flood damage to be covered.

While it may be possible to purchase a windstorm policy in the private market, in many cases you may have to turn to the state run high-risk pool to fully protect our home.

High-Risk Pools in North Carolina

North Carolina has two high-risk insurance pools and where you call home will determine which one is right for you assuming you cannot find coverage in the private market.

Both high-risk plans are pools which basically means that all insurance companies that write homeowners insurance in the state must share the risk of insuring coastal properties.

Here is a quick rundown of the two pools available to North Carolina homeowners:

The FAIR Plan: This was created in 1969 by the North Carolina General Assembly and is available to all homeowners in North Carolina and offers full peril coverage for both residential and commercial. These plans cover damage from wind, hail and fire.

The Fair plan is administered by the North Carolina Joint Underwriting Association (NCJUA). It only covers non-coastal areas west of the intracoastal waterway (ICW) like Shallotte, Wilmington, Jacksonville, New Bern, Washington, Williamston, Elizabeth City. Major metros like Raleigh, Charlotte and Fayetteville are also covered because they are in the coastal hurricane path and homes within these areas would also need wind and hail insurance coverage. Coastal areas or homes on the beach area east of the intracoastal waterway are covered by the Beach Plan, which is detailed below.

It should be noted that both the Fair Plan and Beach Plan are considered insurers of last resort and you should shop for a policy in the private market before turning to either of these plans. Insurer of last resort plans tend to come with hefty premiums and numerous restrictions.

The FAIR Plan offers:

- Dwelling Fire in all areas except those covered by Beach Plan

- Commercial Fire in all areas except those covered by Beach Plan

- The Dwelling and Commercial Fire products provide coverage for windstorm and other perils such as fire, lightning, and vandalism and malicious mischief.

- Dwelling coverage may be written on a replacement or actual cash value basis. Contents coverage is only written under an actual cash valuation provision.

One of the biggest restrictions to the FAIR plan is the coverage caps. Maximum residential coverage limits are capped at $750,000. The cap for personal property is 40% of the building coverage.

If your coverage requirements exceed these coverage limits you may need to purchase additional coverage in the private market. While the FAIR plan offers coverage in areas where it can be difficult to get private insurance, it comes at a cost. Expect to pay 20% to 30% percent more for a FAIR plan.

Additional details on the FAIR plan can be found here.

The Beach Plan: The Beach Plan is also known as The Coastal Property Insurance Pool. The Beach Plan is only available to homeowners that live in specific coastal counties.

According to the North Carolina Joint Underwriting Association website, the following areas fall into the Beach Plan:

Beach Area: All of that area of the State of North Carolina south and east of the inland waterway from the South Carolina line to Fort Macon (Beaufort Inlet); thence south and east of Core, Pamlico, Roanoke and Currituck sound to the Virginia line, being those portions of land general known as the “Outer Banks, all as specified in G.S. 58-45-5(2).

Coastal Area: All of that area of the State of North Carolina comprising the following counties: Beaufort, Brunswick, Camden, Carteret, Chowan, Craven, Currituck, Dare, Hyde, Jones, New Hanover, Onslow, Pamlico, Pasquotank, Pender, Perquimans, Tyrrell and Washington, except that “Coastal Area” does not include the portions of these counties that lie within the Beach Area, all as specified in G.S. 58-45-5(2b).

The Beach Plan offers:

- Dwelling Fire (Beach Territories only)

- Commercial Fire (Beach Territories only)

- Homeowner (Beach and Coastal Territories)

- Dwelling Windstorm and Hail (Beach and Coastal Territories)

- Homeowner Windstorm and Hail (Beach and Coastal Territories)

- Commercial Windstorm and Hail (Beach and Coastal Territories)

- Crime (Beach Territories only)

- The Homeowner, Dwelling, and Commercial Fire products provide coverage for windstorm and additional perils such as fire, lightning, and vandalism and malicious mischief.

- Dwelling coverage may be written on a replacement or actual cash value basis. Contents coverage is only written under an actual cash valuation provision.

Just like the FAIR plan, there are coverage caps. These are basically the same as the FAIR plan. Maximum residential coverage limits are capped at $750,000. The cap for personal property is capped at 40% of the building coverage.

The Deductible is High

Windstorm policies usually come with a different type of deductible. In most cases this will apply to both private market policies and high-risk pool policies.

In many cases, there are two deductibles, one that applies to standard damage such as fire or vandalism and another deductible that applies to wind and hail damage. The standard fixed deductible ($1,000 for example) will apply to standard damage such as fire.

The deductible that applies to wind and hail damage will be a percentage deductible. This means that you must pay a certain percentage of the coverage amount before your insurance takes over.

As an example, if you have $400,000 in home insurance and the wind and hail deductible on the policy is 1% you would have to pay $4,000 out-of-pocket for a wind or hail related claim. Percentage deductible amounts can vary from 1% up to 5%. A 5 percent deductible on a $400,000 policy is a whopping $20,000.

When shopping for a North Carolina wind and hail policy, either in the private market or the high risk pools, be sure you fully understand the type of deductible you are looking at and be sure that you can easily afford it if you have to make a claim.