What Does Insurance Cover After a Natural Disaster

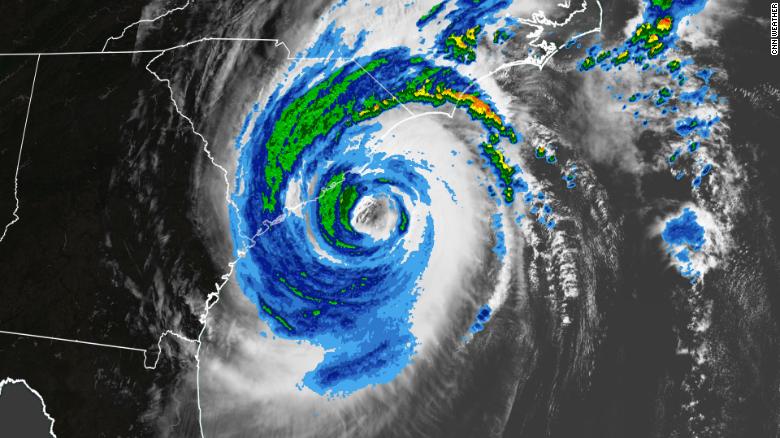

Hurricane Dorian did major damage in the Bahamas and is currently lashing out at the Carolinas. If your home has been damaged or destroyed by Dorian or another major weather event, you probably have questions about just what your homeowners insurance will cover.

We are here to answer your questions. Here is an overview of what you can expect your insurance cover after a natural disaster and what you may have to cover on your own.

What does homeowners insurance cover?

Homeowners insurance will cover damage to your home that is caused by covered perils which include tornados, hurricanes, severe storms, hail, rain, wind as well as fires. The dwelling coverage portion of your policy will pay to repair the structure of your home up to your coverage limits.

In addition to the structure of your home, a homeowners policy will also cover detached structures such as a shed, barn, or even a detached garage. The coverage levels for detached structures is usually a percentage of your total dwelling coverage. While it varies by insurer, 10 to 15 percent is typical. As an example, if you are carrying $250,000 in dwelling coverage, your policy would cover $25,000 in damage to detached structures.

Homeowners insurance will also pay to replace your possessions if they are damaged or destroyed by a storm. Just like detached structures, coverage limits apply. Most policies have coverage level caps for your possessions that are between 45 and 70 percent of your dwelling coverage.

Finally, a homeowners policy will pay additional living expenses if your home is so damaged that you can no longer live in it. This portion of your policy will cover costs such as hotels, restaurant bills and even dry cleaning. In most cases this coverage is limited to a year.

What is not covered?

Homeowners insurance comes with exclusions and to be fully protected you may need additional policies depending on where you live. Almost all homeowner insurance policies exclude flood damage as well as earth movement which includes mudslides, earthquakes, sinkholes and landslides.

If you live in an area where flooding or earthquakes are common, you will need a separate policy to be fully protected. Flood insurance can be purchased from the federal National Flood Insurance Program (NFIP) or a private insurer. Flood insurance can be expensive, especially if your home is waterfront but it can be a financial lifesaver if your home is flooded.

Flood insurance from the NFIP does comes with coverage limits of $250,000 so if it would cost more than that to rebuild your home you may to purchase supplemental coverage in the private market. Even if you live in a low to moderate risk flood area you should consider flood insurance. According to NFIP data, over 20 percent of all flood claims come from low to moderate risk areas. Flood damage is common with hurricanes and if you are not carrying a flood insurance policy, those repair or rebuilding costs will fall to you.

Earthquake coverage also requires a separate policy or rider on your homeowners insurance for you to be fully protected. Earthquake coverage can be fairly pricey but like flood insurance it can be a financial lifesaver if your home is destroyed or severely damaged by an earthquake.

Earthquake insurance typically comes with a percentage deductible which means you will be paying a percentage of your total coverage as a deductible, the percentage can run between 1 and 5 percent. As an example, if you are carrying $300,000 in coverage with a 3 percent deductible you will need to cover $9,000 in costs before your insurance kicks in to cover the balance.

In addition to flood and earthquake exclusions, some policies will exclude wind damage. This is usually state specific, for example, Texas and Louisiana both have state sponsored windstorm coverage as wind damage is often excluded in private market policies.

Always read your entire policy looking for exclusions and purchase supplemental coverage to protect your home from excluded perils.

Be Prepared to Make a Claim

When it comes time to make a claim on your policy after a natural disaster, being prepared will definitely make things easier and ensure that you are paid fairly. Insurers will only cover what they know for sure you lost so make sure you keep an up to date inventory of your personal possessions and your home.

Make sure your policy accurately describes your home and possessions. Make sure that the age of the home is correct, the square footage as well as the number of rooms and the building material used to construct it.

When it comes to your possessions, a full and accurate inventory is the best way to make sure you are quickly and fairly paid in the event you have to make a claim. There are dozens of apps that make this tedious process a bit easier. Go through each room in your home recording the details of your possessions, take photos and video and note the make and model of electronics and appliances. Your inventory should be stored off site or in the cloud.

High-end possessions such as art, jewelry, firearms and other collectibles may be capped on your policy. The majority of homeowner policies cap coverage for these types of items around $1,500. If your collectibles and high-end items exceed this cap you may need to purchase a rider to fully protect your property.