Florida Flood Insurance Increase as Property Value Decreases Due to Hikes!

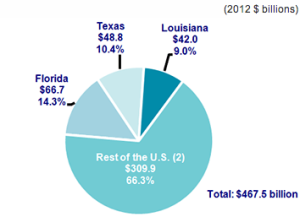

Florida in the top three states by inflation-adjusted catastrphic losses, 1983-2012. At 14.3% compared to other states. (Source: Florida Insurance Information Institute (III)

Changes to the National Flood Insurance program are just around the corner and the steep increases in premiums many coastal residents will be seeing are having a negative impact on real estate prices.

According to a recent article in the Tampa Tribune, owners of an older home in Treasure Island that has a flood elevation six feet below base flood level could see their flood insurance go from $2,500 to $15,000 per year.

Unfortunately, these changes in flood insurance costs come just as Florida, and other coastal areas are starting to see a rebound in real estate prices. Floods cause a huge amount of damage each year and as subsidies come to an end, insurance costs will soar.

According to floodsmart.gov, floods are the number one natural disaster in the United States. Flood claims from 2003 to 2012 averaged more than $3 billion a year and the average claim was more than $34,000.

The Federal Government has been subsidizing the cost of flood insurance for years, especially on older homes that were built before flood maps were updated which made them much more accurate when it came to predicting financial risk.

Changes will be dramatic with homeowners seeing a 10 to 20 percent increase in rates for a primary residence. Second homes and commercial properties will see an even bigger hike at around 25 percent.

These hikes will severely affect homebuyers who could face premiums that range from $6,000 to $20,000 a year just for flood insurance coverage.

Local officials in Florida and other states with large coastal communities have been lobbying congress to stop or delay the increases. A bill that would delay the rate hikes for a year has passed the House of Representatives and is headed to the Senate. The rate changes will go into effect starting October 1st if Congress doesn’t agree to a delay.

The Biggert-Waters Flood Insurance Reform Act in 2012 ordered the Federal Emergency Management Agency (FEMA) to address the $20 billion deficit in the federal flood insurance program which was created when huge disasters such as hurricane Sandy and Katrina resulted in a huge amount of claims.

In order to make the flood program sound it was necessary to pull the subsidies on roughly 20 percent of policies across the country. The majority of these houses were built before 1975 when accurate flood maps were drawn up.

While the law is being implemented gradually, many new homeowners and relators were unaware how the changes would effect them or when they would be put in place. Homebuyers that purchased a home after the law passed in July 2012 more than likely were given the same rate for flood insurance as the previous owners but as policy renewals come up these new owners will be required to get an elevation certificate which will often result in a much higher premium.

The Tampa Tribune article highlighted a family that saw their flood insurance go from $1,000 to $23,000 a year when their policy came up for renewal.

Policy changes are already having an effect on the real estate market with for sale signs reading “No Flood Insurance Required” instead of the more standard, 3 Bedroom, 2 Bath with a pool.

Experts predict that as the premium hikes start to take affect, real estate sales of coastal homes, especially ones with huge rate hikes will drop. Pinellas County in Florida stands to be hit hard with over 51,000 homes and land parcels that may be affected by the changes to the Federal Flood program.

Realtors in Florida have witnessed buyers backing out of sales when they see the insurance estimates in loan documents. There is a concern that these changes will put these homes out of reach for middle class buyers.