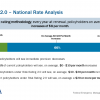

Home in Panama City, Florida suffers from wind and hail damage in 2018. This damaged house is from hurricane Michael. Hailstorms can do a tremendous amount of damage to your house and roof in very short amount of time and if you are not properly insured you could end up having to cover the cost […]