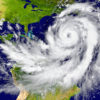

In 2017 there were seventeen named storms that ended up hitting the United States. These storms caused over $200 billion in damage, which makes it a record setting year and much of the damage was caused by flooding due to heavy rains that continued for days in some areas. While private insurance companies stepped up […]