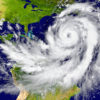

Hurricane Irma and Harvey have done billions of dollars in damage and if your home was uninsured when the storm hit, you will be on the hook for the cost of rebuilding. In the days leading up to the storms hitting, most insurers stopped writing homeowner and car insurance polices in the areas most likely […]