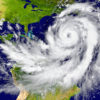

Hurricane Harvey has done a massive amount of damage, in fact it is too early to even get a sense of the total costs of this hurricane. Adding insult to injury is the fact that Hurricane Irma is now bearing down on the Florida Keys and parts of mainland Florida. If your home is located […]