Changing Weather Patterns Mean Homeowners Need To Rethink Insurance Risks

Despite the fact that weather-related catastrophes are increasing, the NAIC survey found that over 56% of homeowners have not reviewed their homeowners insurance policies in over a year.

According to a recent survey from the national Association of Insurance Commissioners (NAIC), less than 22% of homeowners view changing weather patterns and disasters as a major factor when updating their homeowners insurance policy.

As disasters and severe weather become more and more common, the NAIC recommends that consumers consider the risk these storms present and verify what is and what is not covered by their homeowners insurance policy.

In the United States, over 800 emergency or disaster declarations were made from 2005 to 2015. These emergencies resulted in an average of $24 billion in annual insured losses resulting from natural catastrophes. This is a dramatic increase from previous decades.

Despite the fact that weather-related catastrophes are increasing, the NAIC survey found that over 56% of homeowners have not reviewed their homeowners insurance policies in over a year. A whopping 14% were unsure if they had ever reviewed their policy.

In addition, the survey found that only 44% of homeowners have a home inventory and even worse, more than 40% of those that actually have an inventory have not updated it in over a year.

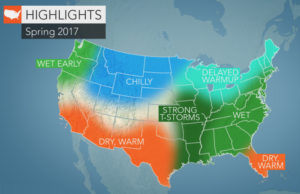

Mike Consedine, NAIC Chief Executive Officer, said in a press release, “During the past decade, the U.S. has experienced significant shifts in the frequency, severity and location of natural disasters. According to our survey, most consumers aren’t connecting the dots between these shifts and the impact on their home insurance needs. Missing these links can be costly.”

Millennials Get It

While the numbers are still pretty low, Millennial’s are much more likely to consider changing weather patterns when it comes to homeowners insurance coverage. Roughly 19% of Millennial’s said that they consider weather issues when it comes to homeowners insurance, compared to only 10% of Gen Xers and a measly 8% of baby boomers.

Millennial’s are also more on the ball when it comes to updating their insurance policy. The study found the Millennial’s were much more likely than other generations to have reviewed and updated their insurance policy within the last five years as well as being more likely to actually have a home inventory and keep it up to date.

A Few Tips

Regardless of which generation you belong to, taking changing weather patterns into account when reviewing your homeowners insurance policy is always a good idea. Here are a few questions you should ask yourself as well as a few tips on how to keep your home safe and make sure you’re fully prepared if you need to make a claim.

Evaluate Your Needs: Experts recommend reviewing your risk profile at least once a year. This is especially true as weather patterns change. Severe hailstorms can cause damage to roofs, and flood patterns can also change, exposing your home to new risks.

When evaluating your risks consider the following:

- Frequent Storms: Are earthquakes, wildfires or other disasters more common in your area now? If they are you may need to increase your coverage or even add additional types of insurance coverage.

- Roof Damage: Does my current policy have a percentage deductible for roof damage? These policies are becoming more common in hail prone states and can dramatically increase your share of a new roof if you need to make a claim.

Instead of a set deductible, the deductible for the roof may be a percentage of your total policy limits. As an example, if your home is insured for $300,000 and you have a 1 percent deductible on your roof, you will be on the hook for the first $3,000 to replace your roof. - Flood or Earthquake Coverage: Do I need flood insurance or earthquake coverage? Flood and earthquake damage is not covered by a standard homeowners policy so if the local flood maps have changed or earthquakes are becoming more common, it may be time for additional coverages.

Other Considerations: Increased weather risk is not the only thing you should consider when reviewing your insurance policies.

If the number of people living in your home has changed you may need to increase or decrease your coverage. The same can be said if you’ve made a major renovation, added square footage, or finished a basement.

Upgrades: If you made upgrades to your home that improve security or make your home more resistant to storm damage you may be eligible for a discount. Sprinkler systems, monitored alarms, storm shutters and wind resistant roofing materials are just a few examples of improvements that may result in a discount.