Consumer Groups Seek to Curb the Force-Placed Insurance Menace in Florida

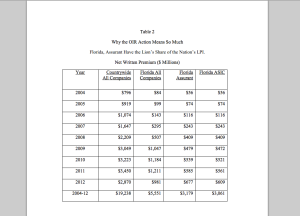

Table 2

Why the OIR Action Means So Much

Florida, Assurant Have the Lion’s Share of the Nation’s LPI.

Net Written Premium ($ Millions)

Harried homeowners in Florida can rejoice in the news that some of the consumer groups in the state have risen up in arms against the menace of force-placed insurance overcharges. The Consumer Federation of America and the Center for Economic Justice intend to appeal to the Florida Insurance Commissioner to investigate the growing menace of exorbitant rates charged on force-placed insurance policies. Homeowners reeling under this menace are meanwhile keeping their fingers crossed that something positive comes out of this intervention.

What is Force-Placed Insurance?

Most mortgage deals empower lenders to demand that homeowners buy suitable home insurance policies on their properties. Florida homeowners are usually asked by their lenders to buy flood coverage. Flooding is common in almost all parts of Florida, caused both by hurricanes and heavy rains. These cause extensive damage to houses in vulnerable areas and it is only natural that mortgage lenders would want to safeguard their investments.

Now, if a homeowner doesn’t have enough Florida home insurance to cover his own property, his lender sends him a notice about insurance deals usually from a partner insurer. If the former still does not buy a coverage plan within the time period specified by the lender, the latter goes off and buys an insurance cover of his choice. The lender then asks the homeowner to compensate him. This is the force-placed insurance scheme.

A force-placed insurance policy typically provides far less coverage than a homeowner’s plan obtained from the market at competitive rates. The former does not protect the homeowner from damages to the contents of the house, liabilities, or even the extra living costs that the owner may have to incur in case any calamity forces him to vacate his property and live elsewhere.

The Woes of the Force-Placed Insurance Scheme in Florida

Many lenders in Florida have been found to abuse the force-placed insurance scheme to squeeze unjustified amounts of money from homeowners.

Firstly, some lenders tend to coerce homeowners to pay for flood coverage even if their properties are not situated in particularly flood-prone areas. Secondly, many lenders buy insurance coverage at prices that are far greater than that what is prevalent in the marketplace; they after all, receive lucrative commissions from insurance companies for doing so. So, homeowners naturally are compelled to cough up more for their force-placed insurance policies.

It has been found that some Florida homeowners with expensive force-placed insurance policies forced upon them pay about 10 times more in premium prices than what they would have to sacrifice for a regular insurance policy obtained from the marketplace. Some Florida homeowners have also complained that their lenders have not only compelled them to pay for force-placed insurance policies but have also pinched more money out of their pockets by backdating the policies to provide retro-active coverage. This is clearly a violation of laws and business ethics. In fact, in some instances, homeowners have claimed that the costs of their retro-active coverage were more than what they pay for the principal and interest on their mortgages in a month.

A Helping Hand

In such a scenario, the move by the consumer groups in Florida is certainly a welcome one and homeowners are praying earnestly that the Florida Insurance Commissioner steps in to take some corrective action and improve their plight.

Florida Home Insurance Resources

Do you have questions about your home insurance coverage? Please visit our FAQ’s page to learn more about homeowners insurance and what’s covered under a standard homeowners insurance policy. You can also learn how to prepare you home for a hurricane in 2013.