FEMA’s new rating system is called “Risk Rating 2.0,” effective October 1st, 2021

A recent report by ValuePenguin looked at the new risk ratings that the Federal Emergency Management Agency’s (FEMA) will be using when determining premiums for flood insurance in the National Flood Insurance Program (NFIP). The report found that millions of homeowners could see noticeable increases in flood insurance costs.

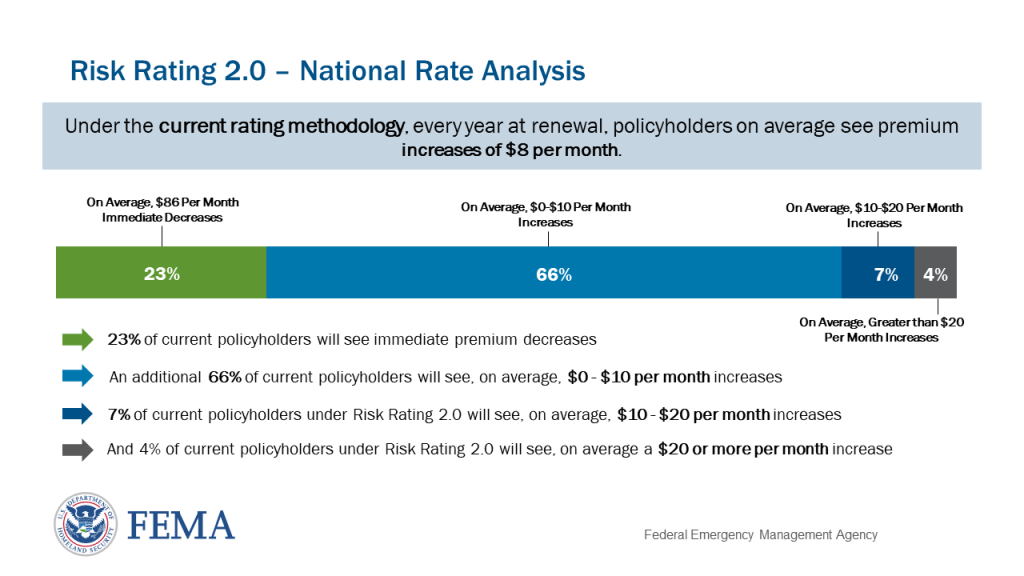

FEMA’s new rating system is called “Risk Rating 2.0,” and takes effect October 1st of this year. The ValuePenguin analysis found that 3.8 million homeowners will see rates increase under the new rules, while roughly 1.2 million homeowners will see a decrease in their flood insurance premiums.

A few other findings of the report:

- The largest NFIP rate increases will impact roughly 4 percent or 192,836 of the 3,846,702 homeowners who will see rate increases under Risk Rating 2.0.

- Over 10,000 homeowners in the following states will see the largest price increases under the new rating structure: Florida, Texas, Louisiana, New Jersey, and New York.

- Almost 8 in 10 existing flood policies in Alaska will see a price decrease. Roughly half of the policies in District of Columbia, Maryland, Michigan, and Utah will also benefit from lower rates.

The rate changes being put in place by FEMA are designed to reflect the actual flood risk that the property presents. However, rate increases will be gradual, and most homeowners will not see year over year rate increases that exceed 18 percent.

It is important to remember that flood insurance policies typically come with a 30-day waiting period before coverage take effect so you must have a policy in place before a storm is headed your way.