Florida’s failed home insurance market continues, will Louisiana be next?

The Louisiana Legislature, in a special session last week passed and funded legislation that is designed to deter insurers from leaving the Louisiana homeowners market. Recent hurricanes have caused financial stress for insurance companies operating in the state. In addition, several insurers have gone into insolvency.

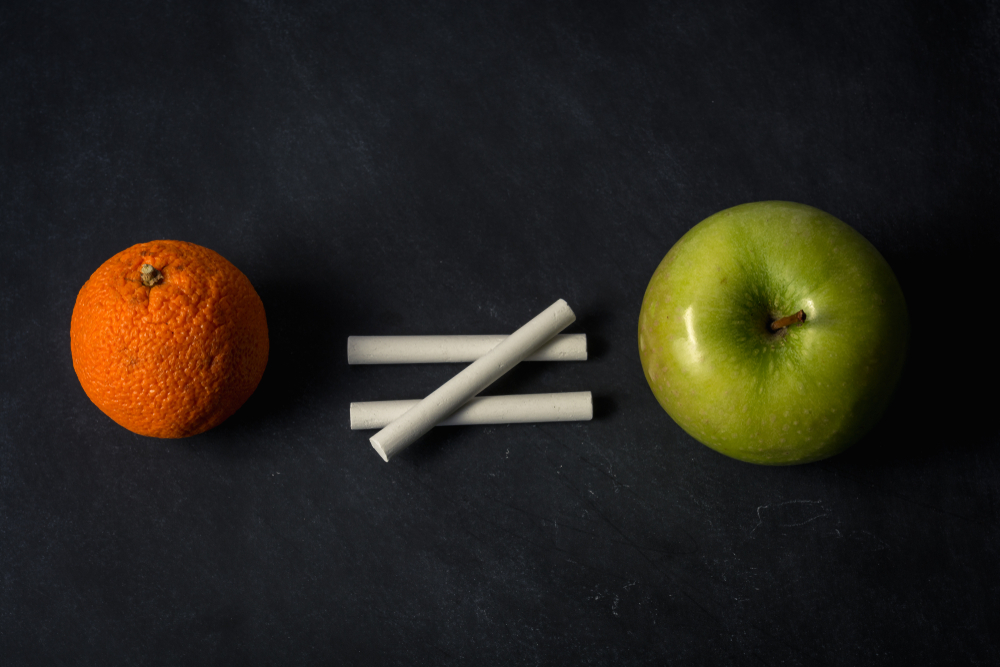

Experts have made comparisons between the Louisiana insurance market to Florida’s which had to hold its own special session in 2022 to help prop up its collapsing insurance market. A recent Insurance Journal article looked at both insurance markets and found a variety of similarities as well as differences.

How the markets compare

The goal of the Insure Louisiana Incentive Program is to create a homeowners insurance market that is affordable and makes homeowners insurance available to all residents of Louisiana.

The legislation that came out of the Florida special session has the same goal but there are major differences in the two markets. Florida’s insurance problems have mainly been caused by frivolous litigation, usually related to roofing claims, that have caused rates to skyrocket over the last few years. In addition to deterring lawsuits, the legislation provides reinsurance to insurance companies that operate in the Sunshine State. Reinsurance is very difficult to find in the Florida market and prevents many insurers from writing policies in many areas of the state.

Louisiana, on the other hand, is experiencing a failing homeowners insurance market due to the damage caused by four major hurricanes that have hit since 2020. Hurricanes Ida, Laura, Delta and Zeta have caused an estimated $17 billion to $25 billion in insured losses. The recent legislation is designed to provide matching grants to keep insurers from leaving from the state.

Louisiana has also been impacted by failures in the Florida insurance market. Many of the insurers that have failed in Florida, FedNat, Gulfstream, Southern Fidelity, Weston and Lighthouse are a few examples, also wrote coverage in Louisiana

The law in Louisiana

While Florida has become the poster boy for insurance fraud, Louisiana has its own share of insurance fraud that pushes up rates.

Louisiana has been well known for insurance fraud for years, if not decades. Staged accidents result in higher car insurance rates for drivers as well as professional truckers. Accidents are faked and scammers work with less than honest doctors to fake injuries and then sue the insurance company for a settlement.

In addition to criminal fraud issues, Louisiana has a tort system that can be troublesome for insurers. Louisiana ranks #7 in the Judicial Hellholes ranking of states with the worst insurance climates. It also achieved a D- grade in R Street’s 2022 Insurance Regulation Report Card study.

Louisiana’s insurance market is stronger than Florida’s

Florida has welcomed a variety of insurance companies into their market that are thinly capitalized, highly leveraged startups which leaves them very vulnerable to both storms and the lawsuits that continue to plague the Florida insurance market.

Louisiana has taken a different approach; its insurance market is mainly made up of strong national insurers. Here is a quick look at the top 10 insurance companies in each state:

Top 10 Louisiana Homeowners’ Insurers

- State Farm

- Allstate

- USAA State Farm

- Liberty Mutual

- Progressive

- Louisiana Farm Bureau Mutual

- UPC

- Farmers

- IAT

- Allied Trust

Top 10 Florida Homeowners’ Insurers

- Universal

- Citizens Property Ins. Corp.

- Tower Hill

- Progressive

- USAA

- First Protective

- HCI

- Florida Peninsula

- Heritage

As you can see, Florida’s top insurers are less well-known insurers, leaving them more vulnerable to market conditions. Another major difference between the two insurance markets is the size of their insurer of last resort. The insurer of last resort is a state backed company that provides coverage for homeowners who cannot find coverage in the private market.

Louisiana Citizens Property Insurance which is the insurer of last resort in the Pelican State writes roughly $35 million in premiums per year while Florida’s Citizens writes close to $1 billion in annual premiums.

For best Florida home insurance coverage options, please call us at 1-888-685-4704 to review companies and rates or get quotes now for your Florida home online.