Home Insurance Pointers for Atlanta Residents Who Live in Flood-Prone Areas

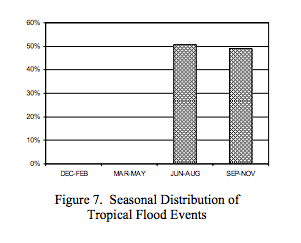

Data shows tropical events were evenly distributed through the summer and fall months. From June to November.

According to a research study carried by some hydrologists at the National Oceanic and Atmospheric Administration, the Atlanta Urban Zone is one of the most flood-prone regions in the entire state of Georgia. There are several low-lying areas in the city and its suburbs and these have witnessed considerable flooding in the recent past.

Lots of Water

Homeowners here have had to spend hundreds and thousands of dollars in water damage restoration. So those who intend to buy real estate properties in Atlanta should ponder this concept when choosing a neighborhood. People who buy properties in these areas have to often fork out more in insurance premium prices than those who stay in neighborhoods that are less prone to flooding.

A Major Threat

The neighborhoods around water bodies such as Proctor Creek, Peachtree Creek, and Sweetwater Creek Gorge; Austell; Peoplestown; and Clayton County that lies within the Atlanta Metropolitan Area are some of the most flood-prone areas in and around Atlanta. This year in June, neighborhoods in Clayton County were flooded just after one evening of heavy rains and a storm.

Another Threat

On the other hand, the historical tornado activity in Austell is above the average for the state and a staggering 154 percent more than the national average. It is thus not surprising that insurance premiums in these areas of Atlanta would be more than the city average.

By the Numbers

For instance, a single-family home priced at around $180,000 has a monthly mortgage of about $920 in Austell while that for a condominium priced at approximately $35,000 is $180. These prices and mortgage rates almost equal that for similarly-sized and even lower-priced houses with like features in the downtown Atlanta area with its bevy of amenities and the proximity to the financial, commercial, entertainment, and recreation spots of the city.

Some of the neighborhoods in Atlanta situated at high elevations include the areas around the Atlanta University Center, the Castleberry Hill Historic District that lies to the south-west of the downtown region, and the area around the Peachtree Center. These areas are much less prone to damage from flooding and thus homeowners here have to shell out comparatively less for their insurance premiums, after taking into account factors such as the price and the size of the properties, their features, and proximity to the various amenities and services available in and around the downtown area.

Just a Thought

What is more, prospective home buyers who wish to buy properties in flood-prone areas of Atlanta may have to upgrade their homes to make them withstand water damage before they can hope to buy a homeowners’ insurance policy that serves their needs. Insurance carriers have been known to refuse coverage to homeowners whose properties they feel, are not fortified adequately.

Sparkling Furnishings

Homeowners in these areas can also lower the premiums on their real estate properties by paying a higher deductible and pooling their insurance policies. They should also consider protecting the valuables inside their home and there are some coverage plans that not only insure the house from water damage but also the contents inside the home. This is an especially wise option for homeowners who have valuable art and furniture collections in their houses.

Recognizing the frequency and severity of flooding damage in Atlanta and its suburbs, many insurance carriers provide multiple coverage options to homeowners. The homeowner is however, free to choose the way he wants to protect his assets.