How does Cost of Living Influence Home Insurance Rates in Columbia (SC)?

Cost of Living Index for Second Quarter 2012 lists Columbia as having a composite cost of living that is 93.3% of the national average. – Columbia Chamber of Commerce

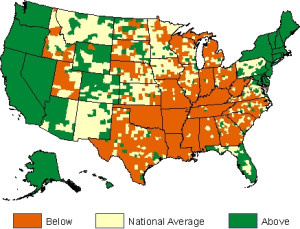

According to the ACCRA Cost of Living Index compiled for various cities across the United States, the composite value for South Carolina is about 93.3 percent of the national average. This means that it is cheaper to live in this state than it is in most other states of the country. This is also true for the capital city of Columbia where the median price for a single-family home, at around $140,000, is still less than that in many other capital cities of the nation.

This makes Columbia a favored city to settle down, buy a house, and raise a family. However, prospective homeowners should keep in mind that the cost-of-living index varies across different neighborhoods of Columbia and this in turn, tends to affect home insurance premium rates.

But, before delving into the relation between cost of living and home insurance premiums in Columbia, it is worth noting what this index is, how it is influenced by different factors, and how it, in turn, affects the standard of living in a particular neighborhood.

The Cost-of-Living Index

For the uninitiated, the cost-of-living index refers to the difference in living costs—the money that has to be forked up to enjoy goods and services—in various regions or across multiple time periods. For instance, the cost-of-living index refers to the relative price of consumer goods that also includes grocery products, the cost of using transportation services, the average expenses of eating out, and any other cost that the residents of an area have to spend to fully live their lives on a day to day basis.

Cost-of-Living Index and Home Insurance Premiums in Columbia

Single-family homes in the 29229 area that comprises neighborhoods like the Denman Loop, Deer Lake Drive, Sherborne Lane, and Stockport Road range in price from $20,000 to $235,000. The cost-of-living index here is 87.9, which is one of the highest in the city. The residents in these neighborhoods also pay one of the highest average home insurance premiums in the city, about $300 more than the state average.

On the other hand, many insurance carriers serving this area do not provide discounts even if the homeowner buys an automobile insurance policy along with their home insurance policies from the same carrier. So prospective homeowners looking to buy real estate property here should keep in mind that they will have to spend more both to maintain their standard of living and protect their homes than they would need to in other parts of Columbia.

In addition, the cost-of-living index in the 29212 area that comprises neighborhoods such as Newbond Way and Kinder Road in Richland County is just above 85. But compared to neighborhoods with higher cost-of-living indices, residents in Richland County pay much lower home insurance premiums—about an average of $750, which is about $247 less than the state average of $997. Many insurance carriers who serve this area also offer premium discounts if homeowners buy multiple policies from the same company.

The above-mentioned examples of the correlation between cost-of-living index and home insurance premium rates should guide prospective homeowners when search for their dream houses. Giving priority to the cost-of-living index when buying a house will help you make a more sound financial decision.