Is My Home Covered for Damages from an Explosion?

House Destroyed By Explosion

The calm of West, a small town in Texas, was recently shattered by an explosion in a fertilizer plant. It was a huge explosion that flattened the factory and badly damaged homes for miles around. Sadly, lives were also lost in the incident. Although the authorities are yet to confirm if the explosion was an accident or an act of sabotage, homeowners across the United States are plagued by a niggling doubt—does my home insurance policy cover my house for damages from an explosion?

The Georgia Homeowner’s Concerns

Homeowners in Georgia in particular are curious to know about the details of their home insurance coverage. There are many industrial and chemical plants in Georgia in densely populated cities such as Augusta and Atlanta. There are also many chemicals and plastic manufacturing units and fertilizer plants in comparatively smaller cities like LaGrange, Thomson, and Sandersville. Many of these units are located not very far away from densely populated residential areas. So, it is understandable why the average homeowner in Georgia would be keen to know if his home insurance policy also covers damages from an explosion. After all, his home is most likely his single largest investment.

Answering Questions and Allaying Fears

After being flooded by queries from concerned homeowners, the Insurance Information Institute has clarified that damages to residential properties from an explosion are covered under home insurance policies. Most home insurance policies cover damages from explosion apart from those caused by other perils like fire and lightning, theft, windstorm and hail, colliding vehicles, and riot and civil disturbance. Such policies include those classified as HO-1, HO-2, and HO-3, the last-mentioned being the most common type of policy that Georgia homeowners hold.

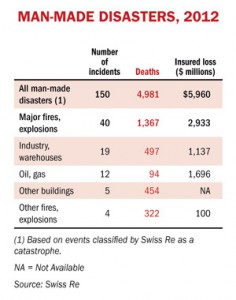

Review the 2012 Man-Made Disasters Chart

It is noteworthy in this context that damages from an explosion include those that may have occurred inside the house like when a cooking or a heating device using propane explodes as well incidents that have may have taken place in a factory located nearby. However, if you are not sure about what your insurance policy covers and what not, you can always clarify with your insurer.

Apart from home insurance policies, apartment, and condo owners’ properties may also be covered for damages caused by an explosion by specific renters and/or condo/co-operative insurance schemes. Some of these plans may also provide coverage for the additional living costs incurred by homeowners if their damaged houses are deemed unsafe for habitation and they are forced to seek alternative living arrangements.

More Soothing News for Worried Georgia Homeowners

By now, Georgia homeowners and especially those who live in the vicinity of factories are probably feeling assured knowing that their houses are covered for damages from an explosion. Here is another piece of information to soothe their worries.

Accidents are unpredictable and can occur at any time. But if authorities prove that an explosion at a factory has been caused by negligence, then homeowners whose properties have been damaged in the incident can claim compensation from the factory owners, contractors, or suppliers who may have contributed to the accident.

So, now that the question, “Is my home covered for damages from an explosion?” has been answered, Georgia homeowners can rest easy and keep their fingers crossed that nothing happens to make them seek a claim for damages due to unforeseen explosions.