Natural Disasters Predictions make Prospective South Carolina Homeowners Worry about Insurance Prices

According to the predictions by the National Oceanic and Atmospheric Administration (NOAA), the recent tornado in Oklahoma is only the first in the spate of many more that are expected to hit the Atlantic shores of the United States this summer season. The NOAA predicts that the states on the Atlantic coastal region will face more multi-billion dollar weather events this year. While these predictions have had existing South Carolina homeowners scurrying to bolster the defenses in their homes, prospective homeowners are worried about the insurance prices they may be compelled to deal with for their newly-acquired properties. The following discussion on the state of affairs in the South Carolina home insurance sector will help prospective homeowners make the right decision.

The Trend for Homeowners’ Insurance Rates in South Carolina

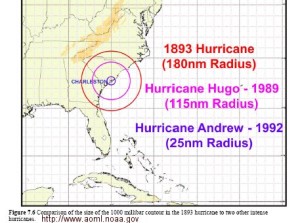

It is indeed true that homeowners’ insurance policies tend to be costlier in the coastal regions of South Carolina than in regions inland. After all, the coastal region is more prone to damages from hurricanes and flooding from tropical storms. In fact, the rates in these vulnerable regions have increased by more than 25 percent in recent years after a spate of natural disasters. For instance, average home insurance annual premiums in coastal regions like Charleston and Beaufort are as high as more than $2,000 while those inland in areas like Lexington Territory and Abbeville Territory are about $875 on the maximum side.

The Stark Reality of the Home Insurance Market in South Carolina

The reality is especially grim for those homeowners who live in the coastal regions of South Carolina. Insurance companies not only charge high for home insurance policies but it is also difficult to even find policies, unless of course, owners can shell out an exorbitant amount. What is more, many basic home insurance policies also do not provide coverage for flooding damages thereby forcing homeowners to pay for multiple coverage plans.

Insurance Tips for Prospective South Carolina Homeowners

In such a scenario and given the grim weather predictions, it is perfectly natural for prospective South Carolina homeowners to worry if they can find insurance policies at reasonable prices for their new properties. Here are a few tips to make life easier and hassle-free for the policy seekers:

- If you want to buy a house in the South Carolina coastal region, then do so right away. It might be some time before you can find a homeowners’ insurance policy that meets your needs and fits your budget.

- Re-plan your finances in case you need to buy an insurance policy from one of the non-admitted carriers that is, an insurer who is not governed by the South Carolina Department of Insurance. These insurance companies tend to charge extremely high rates for homes in the coastal region.

- You can save some extra dollars on your insurance coverage by bolstering your home to reduce the chances of extensive weather damage. Consider installing sturdy shutters, wind-resistant glasses on windows, and reinforced garage doors.

Preparation is the Key

The above-mentioned bits and pieces of information on the current state of home insurance in South Carolina will help prospective homeowners secure the best coverage plan for their needs. The information will also aid existing homeowners prepare themselves for any premium hike.