U.S. Property Claims Satisfaction Study Hits Record Highs

According to the J.D. Power 2020 U.S. Property Claims Satisfaction Study, customer satisfaction with the homeowners insurance claim process has hit a record high after years of improvements over the last decade.

The claims process is an important component of the homeowners insurance experience and if it goes badly it can result in an unhappy customer who will most likely be shopping their coverage when its renewal time. Insurer are aware of this and have spent time and money making the claims process as seamless as possible.

“Home insurers have spent a great deal of time and money refining their claims processing capabilities through a combination of improved client relationship management, enhanced technology and improved quality control,” said David Pieffer, property & casualty lead for insurance intelligence at J.D. Power in a recent press release. “Getting this formula right is critical for insurers because any customer perception of undue effort or unnecessary delays experienced on the part of the customer in the claims process is directly correlated with increased shopping for a new insurer.”

Key Findings of the Study

Here is a quick overview of the major findings of the 2020 study:

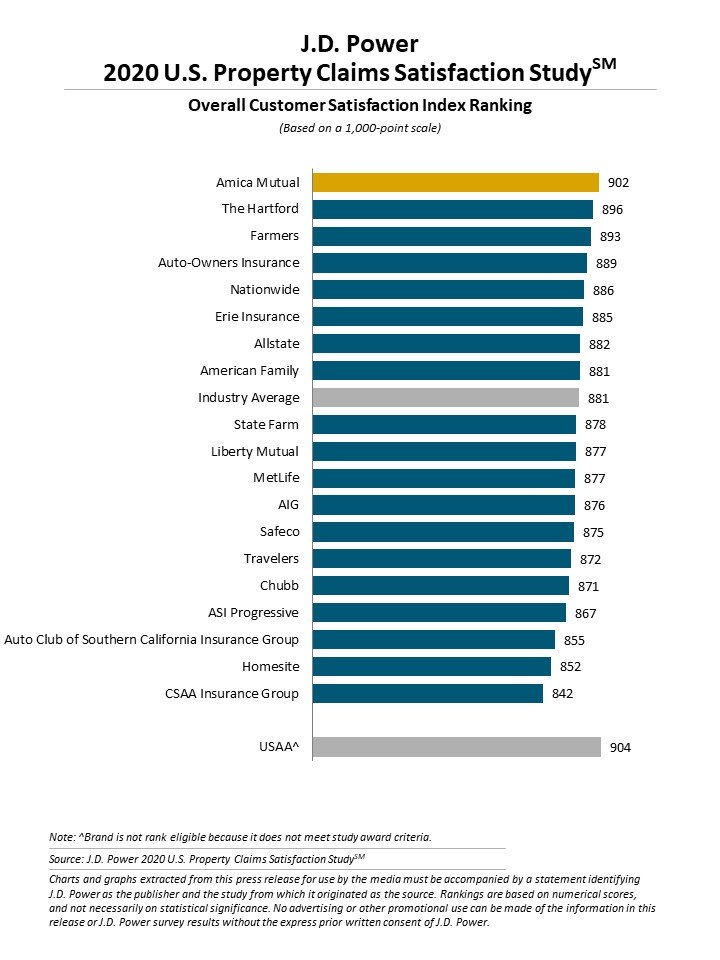

Property Claim Satisfaction: Satisfaction with the claims process hit a record high and managed to outperform other service industries. The overall customer satisfaction with homeowner insurance claims was 881 on a 1,000-point scale. This is a slight increase over last year and a record high for the J.D. Power study.

It is also the highest overall customer satisfaction level among all of J.D. Power consumer-based service studies. Homeowners insurance beat out auto claims (868) as well as direct banking (860) and mail order pharmacy (867).

Premium Increases Are An Issue: There were two factors that resulted in customers shopping their policies after a claim and a premium increase is one of those factors. If a customer sees a premium increase after making a claim or they had to exert a high level of effort to get the claim resolved, their overall satisfaction rating goes down by 85 points. They are also 13.5 time more like to shop their coverage.

Technology is Appreciated: Homeowners appreciate digital solutions for their first notice of loss (FNOL) and estimate process. In addition, they enjoy apps that let them deal with their account online. However, most claimants are not ready to deal with their claim completely online.

Over a quarter of survey respondents (27 percent) still want the entire claim process to take place offline and a mere 4 percent say they would like the entire claims process handled digitally.

The Survey Rankings

It should come as no surprise that Amica Mutual managed a first place showing, this is the ninth year in a row they have ranked number one with an overall score of 902. The Hartford came in second with a score of 896 and Farmers rounded out the top three at 893.

The rest of the rankings shook out as follows:

Lowering Your Premium

If you have recently made a claim and your premium shot up it may be time to look at ways to get your insurance costs under control. Here are a few tips on lowering the cost of homeowners insurance:

Shop Your Coverage: This is probably the best way to lower your insurance costs. Insurers rate risk differently which can result in dramatic differences in premium quotes. Contact at least five different insurance companies for a quote and make sure you are comparing apples to apples in regard to deductibles and coverage levels.

Raise Your Deductible: If you can afford to raise your deductible this will lower your premium. Doubling your deductible can easily shave 20 percent off your rate but make sure you choose a deductible that you can easily afford in the event you have to file a claim.

Bundle Your Policies: If you have your policies with more than one insurance company consider bundling your policies with one insurer. This can result in a 20 to 25 percent discount.

Discounts: Insurers offer tons of discounts and your job is to make sure you are getting every discount you are qualified to receive. Ask your agent to do a discount review to make sure all available discounts are being applied to your policy.

Increase Security: Putting in a monitored security system will result in a significant discount as it lowers the insurers risk. Be sure to notify your insurer after it is installed and ask them to rerun your premiums.