Why does the Florida home insurance market have so many problems?

The Florida homeowner insurance market has been in trouble for almost a decade at this point. As the number of lawsuits related to dubious roofing claims continues to rise, insurance companies continue to raise their rates or pull out of certain areas altogether. While the Florida legislature has attempted to stem the flood of rising premiums, they have not yet been able to significantly lower homeowner insurance rates or even stop the yearly increases.

We thought it might be a good idea to write up a general overview of the issues that the Florida is currently facing as well as a brief overview of the latest efforts by the Florida legislature to address these issues.

Problems in the Florida Homeowners Market

The Florida Chamber of Commerce recently held a legislative discussion that focused on the issues in the Florida homeowners insurance market. Senator Jeff Brandes, who co-sponsored recent legislation that attempted to deal with skyrocketing premiums presented some of his findings and most of them were fairly shocking. Here are the highlights:

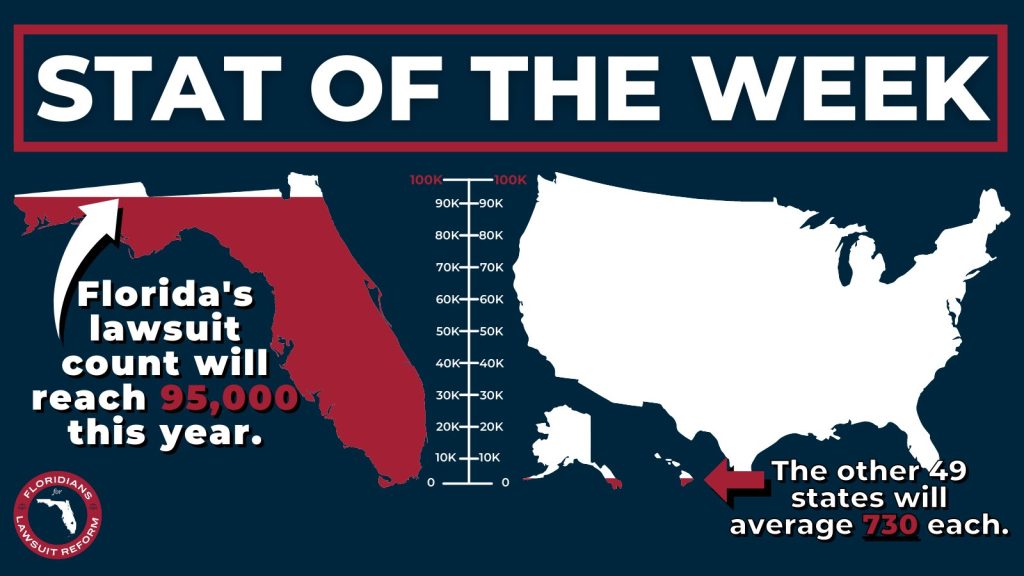

- Florida will hit 95,000 lawsuits this year while 49 other states average 730 each. That means if the US had 130 other states, Florida would still have 50% of the lawsuits.

- Whatever homeowners premium you are currently paying, 55% goes to protect your home while 45% goes to litigation.

- Every homeowner/property owner will have to pay 60% more if we want insurance companies to be able to pay actual claims to Floridians who suffer real damage.

- Florida is the only state, in the US, Canada, EU to have homeowners and no insurance available to buy. The insurer of last resort in Florida is growing so fast as companies go under, they may have to withdraw from certain markets.

- This year 12 insurance companies are on a warning track which means they may be on their way out of business, which reduces the number of insurance companies operating in the state.

Citizens Property Insurance Corporation (Florida’s insurer of last resort) President and CEO Barry Gilway has also made recent statements about the state of the homeowners insurance market in Florida which were equally depressing. When asked about the homeowners market in the Sunshine state, Gilway said, “I would say the industry is on life support.”

Gilway made a variety of points regarding market conditions that were summarized in a Florida Chamber of Commerce article. Here are a few of the more concerning facts he presented:

- In 2020, only a handful of Florida’s 52 private insurance companies made a profit. Net losses for the group exceeded $828 million.

- Some insurers in Florida are reducing their exposure by leaving particular regions of Florida or making their requirements more stringent. As an example, some carriers will only insure a property with a roof less than 10 years old or have placed caps on water or roofing losses.

Due to rising litigation costs, insurance companies have been requesting double digit rate increases over the past few years. Unfortunately, as the insurer of last resort, Citizen’s rate increase is capped at 10 percent for each individual policy.

Due to their inability to raise their rates to actually reflect the risk in the market, Citizens is now the cheapest option for homeowners 91% of the time. This has led to a flood of homeowners moving policies to Citizens. According to Gilway, Citizens is averaging 4,500-5,000 new policies each week coming from policyholders no longer able to find comparable coverage in the private market.

In January 2020, Citizens had 444,000 policies with $112 billion in insured exposure. Their policy count has now grown to 715,000 policies with $200 billion in exposure and Gilway says they are on track to top 1 million policies by the end of 2022.

The big downside to all these people switching to Citizens is the risk of an assessment or “hurricane tax” that will impact all Floridians if a major storm hits and Citizens exhausts all its surplus.

What legislators have done to help

It’s obvious that Florida’s homeowner insurance market is in trouble, legislators have passed a couple of bills that were supposed to help. While they have made a bit of difference, a major fix has eluded them so far. Here is a quick overview of the most recent legislation.

Senate Bill 76

This bill addresses some of the issues affecting the state’s homeowners insurance market.

The bill includes the following:

- Changing the eligibility, rate glidepath and actuarily sound rate indication for Citizens Property Insurance Corp.

- Replaces the one-way attorney fee-statute which will make the recovery of attorney fees and costs contingent on obtaining a judgment for indemnity that exceeds the pre-suit offer made by the insurance company.

- Reduces the claims deadline on all claims down to two years from the date of loss. There is an exception for on supplemental claims which will have an additional year.

- Requires plaintiffs to file a pre-suit demand at least 10 days before filing an actual lawsuit against an insurer. The demand must include an estimate of the demand, the attorney fees and costs demanded as well as the amount in dispute. It also disallows pre-suit notices to be filed before the insurance company makes a determination of coverage; and allows an insurer to require mediation or other form of alternative dispute resolution after receiving notice.

This bill will also address issues related to roofing claims. Changes include:

- Would make it illegal for roofing contractors or any person acting on their behalf to make a “prohibited advertisement,” including an electronic communication, phone call or document that solicits a claim.

- Prohibits roofing companies or independent adjusters from offering anything of value for performing a roof inspection, or from offering to interpret an insurance policy or file a claim or adjust the claim on the insured’s behalf.

- Prohibits a contractor from issuing a contract for repairs that does not include a detailed cost estimate of the labor and materials required to complete the repairs.

If a roofer or other person representing a roofing company is found in violation of these restrictions, they could face a potential fine of $10,000 fine for each violation.

Senate Bill 54

This bill deals with car insurance and repeals the no-fault personal injury protection (PIP) system in the state. It will be replaced with a mandatory bodily injury requirement starting at $25,000 for all drivers in the state of Florida.

How insurance is going to ruin Florida real estate

Brad Dohack of Gulf Pointe Properties in Estero, Florida has a video on YouTube sharing how there are some serious changes ahead in regards to home insurance and homeowners of Florida need to be aware. See video below.