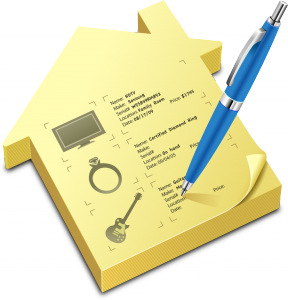

When it comes to homeowners insurance, there are typically a couple of coverage options and choosing the right one can have a major impact on your claim. While most insurers these days have made replacement value standard, there are still homeowners insur […]