Compare quotes for your home in 32824! Compare the best 12 carriers in minutes.

32824, FL Home Insurance

In the zip code of 32824, the population size is around 57,412, which consists of 17,605 occupied homes in your area. We often hear homeowners ask us what the average home insurance premiums are for residence living in Orlando, FL. A few years ago, a study was done and found that the average home insurance rates for Florida are around $2,009 per year for a standard homeowners policy. At GetHomeInsuranceQuotes.com, we help homeowners find cheaper rates and better coverage for an existing or new home purchase opportunity. We have partnered with 12 major home insurance companies that have the most competitive rates for homes in the 32824 zip code location. Our savings model helps you not only save up to 40% or more, but also includes enhanced coverage options to help protect your home and family while livings in Orlando. If you enter your zip code for the home you would like to shop and compare rates for today, we can help you review the premiums and coverage online or over the phone. Give us a call now at 1-855-976-2656 so we can help you compare rates today!

If you would like to review more information on rates within your area, please click Orlando, FL Homeowners Insurance Online Rates Today!

32824 Home Insurance Average Premiums

For the 32824, homeowners insurance rates may vary on deductible, coverage amount and property details. Below is a list of the averages based on the cost of an annual home insurance premium.

| Coverage Amount: | Annual Premium |

|---|---|

| 1800 sq. ft. or below (discounts applied) | $1759 /yr. |

| Average Coverage: | $2009 /yr. |

| 2600 sq. ft. or higher (all discounts applied) | $2309 /yr. |

What is the average home insurance cost for a home in 32824?

- • The average homeowners insurance premium paid annually for a home in 32824 is around $2009 per year.

What does it cost on average per month for home insurance in 32824?

- • Homeowners in 32824 pay a monthly average cost per month around $167.00.

What kind of discount could I get if I combine my home and auto insurance together in 32824?

- • Autoowners in 32824 can receive a 20% to 25% discount if they own a home and would like to group or bundle their car and home insurance together with one insurance company.

You can easily shop and compare home insurance rates within Orlando, check out other zip codes nearby 32824.

To review average rates in another zip code, click on a zip code below:

32837 | 32810 | 32807 | 32833 | 32832 | 32824 | 32835 | 32827 | 32817 | 32809 |

Home Replacement Cost Coverage in 32824

Average Building Cost Per Square Foot in 32824: $167

Location: Orlando, Florida (Orange County)Average Square Footage in 32824: 1,575 Sq. Ft.

When building or updating a home, it's always good to review the average cost per square foot to build in 32824 before you start any project. Orlando homeowners pay on average around $167 per square foot to build a home. Another great reason to know the average cost to build is for your homeowners insurance policy. A standard homeowners policy will help you cover the replacement cost of your home due a fire or any other named perils on your policy. Calculating your dwelling coverage for your home in 32824 is extremely helpful when estimating how much replacement cost coverage you need. We highly recommend that you have enough dwelling coverage to rebuild your home if it was destroyed by a covered peril.

Here is how you determine your replacement cost. If we take an average home in 32824 and want to estimated the dwelling coverage, than we will need the square footage of the home which is 1,575 sq. ft. and the average cost to rebuild the home in this area is around $167 per square foot would be considered a base estimate cost. These two numbers would allow us to generate the replacement cost needed for an average size home in the Orlando area. If the home is new or has been upgraded, you will want to add $50 to $100 or more per square foot to equally cover the replacement cost to restore a home back to it's original condition.

| Home Improvement Status | Price per Sq. Ft. | Square Feet | Dwelling Coverage |

|---|---|---|---|

| Basic Home Features | $167 | 1,575 | $263,100 |

| Additional Upgrades & Added Features | $209 | 1,575 | $328,875 |

| Major Home Updates or Advancements | $251 | 1,575 | $394,650 |

It's important to understand that when you estimate your replacement cost of your home in the 32824 zip code area, it will be the cost to replace the structure of your home, not the additional value of the property that is factored in when purchasing a new home.

Best Homeowners Insurance Agencies in 32824

Best Home & Auto Insurance Agencies in 32824

Freedom Insurance

Address: 5105 South Orange Avenue Orlando, FL 32824Phone:

Website: http://www.freedominsuranceco.com/

Info:

Housing Demographics for 32824

Population Review for 32824 Zip Code

For the city of Orlando, the population within 32824 has increased to over 64,107 residents in population size. The current population total is 57,412. We have broken down the population based on race below. In 32824, there are over 27841 in male population and 29571 females.

| Population | Values |

|---|---|

| Total Population | 57,412 |

| White Population | 15560 |

| Black Population | 7008 |

| Hispanic Population | 36297 |

| Asian Population | 3648 |

| Hawaiian Population | 85 |

| Indian Population | 252 |

| Other Population | 12735 |

| Male Population | 27841 |

| Female Population | 29571 |

| Population Estimate | 64107 |

Household Data for 32824

The average number of homes in 32824 is around 17,605, there are an average of 3.26 per household. The average house value according to local real estate values is around $263,100. Please review the following demographics below for average income and media age.

| Housing / Income Data | Values |

|---|---|

| Households Per Zipcode | 17,605 |

| Persons Per Household | 3.26 |

| Average House Value | $263,100 |

| Income Per Household | $68083 |

| Median Age | 35.8 |

| Median Age Male | 34.7 |

| Median Age Female | 37.0 |

| 32824 Details | Values |

|---|---|

| State | FL |

| State Full Name | Florida |

| City Type | P |

| City Alias Abbreviation | |

| Area Code | 321/407/689 |

| City | Orlando |

| City Alias Name | ORLANDO |

| County | Orange |

| County FIPS | 095 |

| State FIPS | 12 |

| Time Zone | 5 |

| Day Light Saving | Y |

| MSA | 5960 |

| PMSA | |

| CSA | 422 |

| CBSA | 36740 |

| CBSA_DIV | |

| CBSA_Type | Metro |

| CBSA_Name | Orlando-Kissimmee-Sanford, FL |

| MSA_Name | Orlando, FL MSA |

| PMSA_Name | |

| Region | South |

| Division | South Atlantic |

| MailingName | Y |

| Economic & Growth Review | Values |

|---|---|

| Number Of Businesses | 1272 |

| Number Of Employees | 24778 |

| Business First Quarter Payroll | 294905 |

| Business Annual Payroll | 1249378 |

| Business Employment Flag | |

| Growth Rank | 0 |

| Growth Housing Units 2003 | |

| Growth Housing Units 2004 | |

| Growth Increase Number | 0 |

| Growth Increase Percentage | 0.0 |

| Metropolitan Details | Values |

|---|---|

| CBSA Population | 2134411 |

| CBSA Division Population | 0 |

| Congressional District | 09 |

| Congressional LandArea | 1707.49 |

| Delivery Residential | 19665 |

| Delivery Business | 1171 |

| Delivery Total | 26456 |

| Preferred Last Line Key | Y22611 |

| Classification Code | |

| Multi-County | |

| CSA Name | Orlando-Lakeland-Deltona, FL |

| CBSA_DIV_Name | |

| City State Key | Y22611 |

| Land Area | 33.496000 |

| Water Area | 0.565000 |

| City Alias Code | |

| City Mixed Case | Orlando |

| City Alias Mixed Case | Orlando |

| Box Count | 0 |

| SFDU | 1926 |

| MFDU | 3877 |

| State ANSI | 12 |

| County ANSI | 095 |

| ZIP Intro | |

| Alias Intro | |

| Facility Code | P |

| City Delivery Indicator | Y |

| Carrier Route Rate Sortation | D |

| Finance Number | 116915 |

| Unique ZIP Name | |

| SSA State County Code | 10470 |

| Medicare CBSA Code | 36740 |

| Medicare CBSA Name | Orlando-Kissimmee-Sanford, FL |

| Medicare CBSA Type | Metro |

| Market Rating Area ID | 48 |

| County Mixed Case | Orange |

Florida Homeowners Insurance News & Information

-

Florida Homeowners Can Cut Insurance Bills —Here’s How, and Which Companies are Worth a Look Posted on Tuesday 11th November, 2025

Florida homeowners have spent years paying some of the highest homeowner-insurance premiums in the nation. But the market is slowly stabilizing and there are concrete, immediate steps homeowners can take to shrink premiums — from simple paperwork to Florida’s “My Safe Florida Home” program — while shopping smarter for companies that combine strong service with […]

-

Homeowner’s Insurance Rates Spiking Over $3,000 a Year on Average Posted on Friday 19th September, 2025

According to a recent report by The Zebra, the average homeowner is paying roughly $3,000 a year for homeowners insurance. Unfortunately, this is just the nationwide average, in many states premiums are dramatically higher for most homeowners. According to the Zebra report, the most expensive states for homeowners insurance are: Nebraska: $7,920 Oklahoma: $7,426 Kansas: […]

-

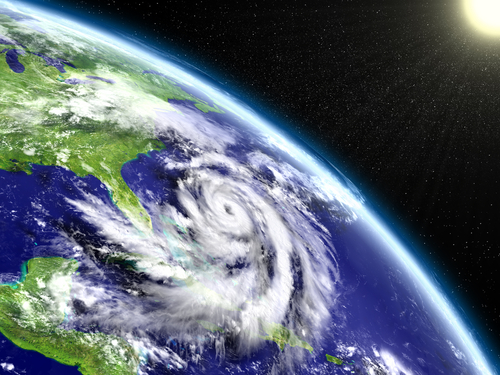

Homeowner’s Insurance Premiums Skyrocket: Forcing Homeowners to Consider Moving Posted on Thursday 11th September, 2025

While states like Florida, California and Louisiana have seen climbing insurance costs for years due to severe weather, flooding and hurricanes, other states, Colorado and Illinois are good examples, are seeing climbing rates as well due to hailstorms and wildfires. As homeowner’s insurance premiums skyrocket, for some policyholders, the math no longer makes sense forcing […]

-

Homeowners in Florida Finally See Relief From Higher Insurance Costs Posted on Wednesday 27th August, 2025

According to a recent Realtor.com article, homeowners in Florida, at least some of them, may finally seem some relief from higher homeowner insurance costs. Florida Peninsula Insurance which is one of the largest private party property insurers recently announced that it is hoping to significantly lower premiums for roughly 170,000 policyholders. Florida Peninsula has filed […]

-

Florida Homeowners Are Concerned About Property Insurance Crisis Posted on Tuesday 1st July, 2025

Insurance rates are rising at unprecedented rates, causing millions of people to struggle with the new premiums. In the last three years, insurance rates have doubled in some areas. Homeowners fear for their houses while their representatives in Congress struggle to help. Insurers are pulling out of states like Florida as damaging hurricanes and powerful […]

-

How to Prepare Before Hurricanes Threaten Florida Posted on Monday 19th May, 2025

How to Prepare Before Hurricanes Threaten Florida Posted on Monday 19th May, 2025

Hurricane season is quickly approaching and one of the most important things to do before a storm hits is to make sure your insurance coverage is up to date and your coverage levels are sufficient in the event your home is damaged by severe weather. Regardless of whether you own a home or are renting, […]

-

New Home Insurance Company Launches in Florida, Shows Signs of Improvement Posted on Tuesday 13th May, 2025

According to Office of Insurance Regulation and leaders in the industry, Florida may finally be emerging from the insurance crisis that it has suffered through for the last decade. Insurance companies operating in the state are starting to stabilize rates and new insurance companies are entering the Florida market. Recently, the Office of Insurance Regulation […]