Compare quotes for your home in Rhode Island! It's easy and only takes a minute! Compare up to 12 carriers.

Rhode Island Homeowners Insurance Quotes

Rhode Island is the smallest state in the country when it comes to area size, but it packs a huge punch when it comes to quality of life. It has 400 miles of coastline with Newport as its crown jewel. Considered the sailing capitol of the world by many, Rhode Island’s coastline is dotted with Guided Age mansions as well as award winning restaurants.

Newport is not the only jewel in Rhode Island’s crown, Washington County has pristine beaches that will make you want kick off your shoes and get some sand in your toes. East Bay is a beautiful place to bike on a lovely coastal bikeway and Warwick is a shopper’s paradise.

Rhode Island is the eighth least populous state in the country but the second most densely populated. If you are thinking about moving to Rhode Island, you can’t go wrong. It doesn’t matter if you are considering a small town like Jamestown or one of our bigger cities such as the Providence you will not regret making the move to The Smallest State.

Rhode Island Facts

Rhode Island currently has a population of 1,052,567. This breaks down to 4,758 households per zip code and the average number of people living in a household is three. The average household income in Rhode Island is a very respectable $40,766 regardless of whether you live in Bristol County or Kent County.The cost of home ownership in Rhode Island is very affordable with the median house price coming in at $119,896.

Homeowners Insurance in Rhode Island

Unfortunately, all of our coastline comes at a cost. Homeowners insurance in Rhode Island is on the pricey side. The average premium runs $1,334, which is almost 22 percent above the national average.There are ways to help drive down the cost of your insurance premium, everything from bundling your coverage to upgrading your home can make your home insurance more affordable. Here are few tips to help lower your insurance costs:

Shop Around: This is number one on most experts list. Shop your coverage with at least six insurance companies and make sure you are comparing apples to apples when it comes to the deducible and coverage levels. We can help you find a great policy and our national insurance partners will send their best quotes directly to your inbox.

Discounts: Discounts offered by insurance companies can shave your premium down significantly. It doesn’t matter if you live in Warwick or Smithfield, there are plenty of home insurance discounts available. Bundling, staying claim free and adding a security system will all result in a discount on your premium.

Upgrade Your Home: If you live on the coast or in an area that is prone to storm or hail damage, upgrading your home with a wind and hail resistant roof and storm shutters can garner you a major discount.

Most consumers are not aware that there are a number of different homeowner insurance policy types, each one is designed for a specific type of dwelling. Here is a quick overview of a few homeowner policy types:

HO-3: This is the most common type of policy. It protects a standard home and covers damage from all perils except ones that are specifically excluded in the wording of the policy. It’s important to note that all homeowner policies exclude flood and earthquake damage.

H0-6: If you live in a condo or co-op, this is the type of coverage you need. It protects your personal property and also covers the specific areas of the building that you own.

HO-4: This is often referred to as renters insurance and will protect all of your personal property in your apartment. It also offers liability coverage in the event that someone is injured in your apartment.

Factors to Consider in Rhode Island

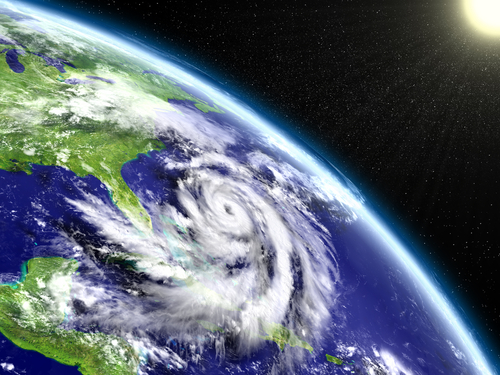

Coastal weather can be a major factor when it comes to homeowner rates. Hurricanes and hailstorms can cause major damage to your home and these types of storms push up rates for everyone.It is important to remember that homeowners insurance should be saved for major events. Numerous small claims on your policy will push up your rates much more than one large claim. Industry experts recommend paying for small damage out of pocket and saving your insurance for major events.

If you are considering a move to Rhode Island, whether it West Greenwich or Pawtucket we can help you find a great homeowners policy at an affordable price. Our national insurance partners will send quotes directly to your inbox so you can compare them at your leisure and find the best policy for your specific needs.

Get started now, contact us and start shopping for a great homeowners policy.

Average Homeowners Insurance Premiums in Rhode Island

With over 95% of all Americans are known to have homeowners insurance coverage, it's important to know what Rhode Island homeowners are paying on average. Did you know that the average homeowners insurance premium in Rhode Island is $1788? Rhode Island is now ranked 5 in the country. The country wide average for homeowners in the United States is $1,311. This means the average home insurance premium in Rhode Island is 36.38% more than the national average.

| Year | Average Annual Premium | Average Monthly Premium | State Rank (Overall) |

|---|---|---|---|

| 2020 | $1788 (3.3%) | $ 149 | 5 |

| 2019 | $1731 (6.2%) | $ 144 | 5 |

| 2018 | $1630 (4.97%) | $ 136 | 5 |

| 2017 | $1551 (3.61%) | $ 129 | 6 |

| 2016 | $1496 (3.4%) | $ 125 | 7 |

When we combine the state averages over the last decade, the Rhode Island overall average is estimated to be around $1,429.40. Our homeowners insurance quoting and rating process helps you compare homeowners insurance quotes, coverages and premiums. Rhode Island current state rank compare to the rest of the country is #5. Consider shopping your Rhode Island home insurance with us so we can help you save up to 40% or more on your policy.

Find Local RI Homeowners Insurance Quotes & Coverage

For more information on homeowners insurance in your area, choose a county below:

Rhode Island Homeowners Insurance News & Information

-

Is the U.S. Home Buying Market Going to Drop in 2025? Posted on Friday 4th July, 2025

Housing Crisis, Low prices. Graph, Residential Building, Built Structure, Chart, Home Finances, Recession, Arrow, Real estate. The housing market is falling. A recent report from the Harvard Joint Center for Housing Studies found that U.S. homebuying has dropped to its lowest levels since the mid-1990s. The report, The State of the Nation’s Housing 2025 blames record high […]

-

Florida Homeowners Are Concerned About Property Insurance Crisis Posted on Tuesday 1st July, 2025

Insurance rates are rising at unprecedented rates, causing millions of people to struggle with the new premiums. In the last three years, insurance rates have doubled in some areas. Homeowners fear for their houses while their representatives in Congress struggle to help. Insurers are pulling out of states like Florida as damaging hurricanes and powerful […]

-

Upgrading Your Home Against Disasters Can Help Save You Money On Your Insurance Posted on Thursday 26th June, 2025

Upgrading Your Home Against Disasters Can Help Save You Money On Your Insurance Posted on Thursday 26th June, 2025

Ron Watson’s roof on his Alabama home looks the same as all his neighbors’ roofs. Yet his is saving him money every year. With the help of nails specifically designed to stay in place during high winds, along with other construction elements, Watson’s roof is less likely to be damaged in natural disasters, like hurricane […]

-

Should I consider climate changes when buying a new home? Posted on Saturday 21st June, 2025

Climate change is on our doorstep, so now more than ever, it’s essential to consider the local climate when buying a new home. Not only is the current climate important, but experts suggest homeowners look towards the future. How will the next 10, 20 or 30 years impact your new purchase? The increasing frequency of […]

-

How to Prepare Before Hurricanes Threaten Florida Posted on Monday 19th May, 2025

How to Prepare Before Hurricanes Threaten Florida Posted on Monday 19th May, 2025

Hurricane season is quickly approaching and one of the most important things to do before a storm hits is to make sure your insurance coverage is up to date and your coverage levels are sufficient in the event your home is damaged by severe weather. Regardless of whether you own a home or are renting, […]

Rhode Island Housing & Real Estate Data

| Details: | Staticstics |

|---|---|

| Total Housing Units | 463388 |

| Occupied Housing Units | 413600 |

| Vacant Housing Units | 49788 |

| Vacant Housing Units for Rent | 15763 |

| Vacant Housing Units Rented Not Occupied | 727 |

| Vacant Housing Units For Sale | 5171 |

| Vacant Housing Units Sold Not Occupied | 1219 |

| Vacant Housing Units For Seasonal Occasional Use | 17077 |

| Vacant Housing Units All Other Vacants | 9831 |

| Housing Units Homeowner Vacancy Rate Percent | 2 |

| Housing Units Rental Vacancy Rate Percent | 8.8 |

| Housing Tenure Occupied Units | 413600 |

| Housing Tenure Occupied Units Owner Occupied | 250952 |

| Housing Tenure Occupied Units Owner Occupied Population | 650674 |

| Housing Tenure Occupied Units Owner Occupied Averge Household Size | 2.59 |

| Housing Tenure Occupied Units Renter Occupied | 162648 |

| Housing Tenure Occupied Units Renter Occupied Population | 359230 |

| Housing Tenure Occupied Units Renter Occupied Average Household Size | 2.21 |

Understanding Rhode Island Homeowners Insurance

When shopping for Rhode Island homeowners insurance quotes you should be aware of the various types of insurance policies that are available in your area:

- HO-3: This is the most common type of homeowers policy. This policy type protects your home against all perils, except ones that are specifically excluded. In most cases earthquake and flood damage are excluded.

- H0-6: This policy type is specifically written for condos or co-ops. If you own a condo or live in a co-op building this type of policy is a necessity. A HO-6 policy covers both your personal belongings and the structural parts of the building that you own. There are 16 disasters listed on a typical policy that HO-6 protects against.

- HO-4: If you are looking for Rhode Island renters insurance, a HO-4 policy is a great option. Renters insurance will cover your contents as well as offer liability coverage in the event a person is injured in your apartment.

While other types of policies exist, these are the most common ones. A HO-2 is a more basic policy that offers reduced coverage levels and a HO-5 is a high-end policy that offers increased protection.

If you are shopping for a new home in Rhode Island, homeowners insurance is a must do. We can help you find the perfect policy for your new home, regardless of whether you need a standard HO-3 policy, HO-6 or renters insurance, our site makes shopping for homeowners insurance quotes easy. Visit our online quoting application today and let us help you shop and compare up to 12 different Rhode Island rates and coverage options.